ACTIVE V/S PASSIVE INCOME

“Always build multiple sources of income, never rely on one.”

Robert Kiyosaki in his book "Rich Dad Poor Dad" mentioned how financial planning is the secret behind true success.

This is usually not taught to us in schools and colleges but is claimed to be the most vital knowledge to elevate your financial status.

When an individual puts hours of hard work and intellectual contribution for an organisation or self, he gets capital or some return for the work. That is what we refer as income.

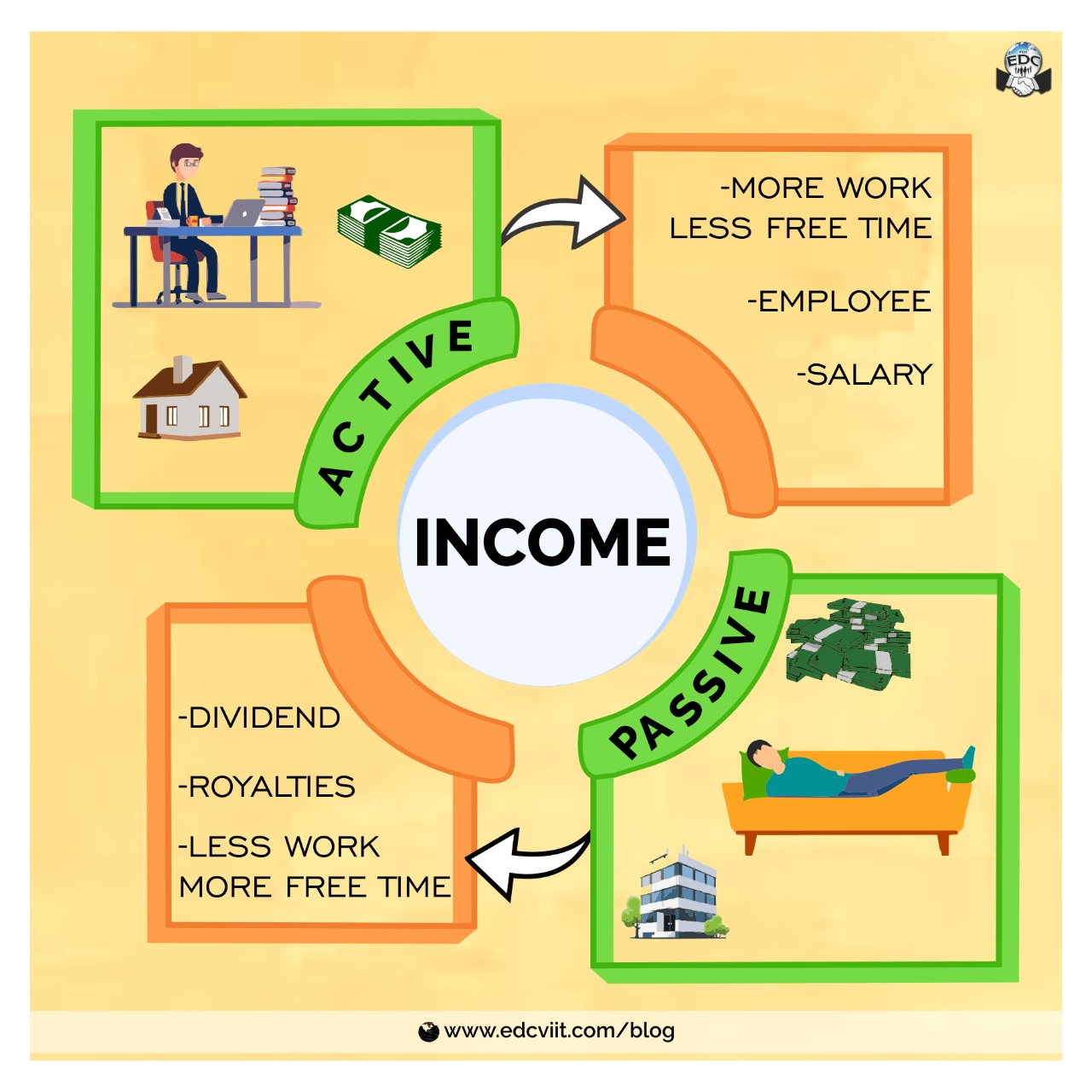

In general we come up with two types of incomes- Active and Passive. Active income as the name suggests is earned actively. As long as you work, you will receive money. Once you are old or ill, this income stops. Passive income on the other hand means putting hard-work and time at an initial stage and after that very less to no work for earning. You just need to invest time to once ensure everything is at its place. This kind of income usually comes from investing in REIT(Real Estate Investment Trust), dividend stocks , investing in stock market, high yeild saving accounts and money market funds.

Imagine starting a YouTube channel. You put on regular videos and after a while you start getting more and more views. Now even if you stop posting videos, the views are gonna increase and this results in putting money in your pocket. Imagine investing in a startup or buying stocks and holding it for a specific period of time (you need some knowledge before investing). The money builds along a period due to compound effect. But you can't get these scenarios in a job except for promotion.

Now, not to get it wrong. Creating a passive income stream is a massive undertaking. It is said to be quite risky if done without prior knowledge of the investment systems. Investing in stock market and divident stocks takes a huge risk toll if you do not do it under proper guidance and knowledge. It involves the investment of a tremendous amount of time. It requires skillsets and is only achieved with practice. During that investment of time, you receive no income. You’re investing your time with the hopes of producing an income down the road, not today. With active income, the money you earn is directly correlated to the time you work. But passive income continues to pay you long after the work has been completed.

Many successful people start their journey by working for a job and earn active income in order to survive and feed the passive income stream they are building. They start a side hustle and a side business. Once they are assured that the stream is giving them more than they would by working a job, they leave the job and focus on the stream and then invest the money in building another stream and this cycle goes on.

At last, we would say that a person should not depend on single stream of income, you should have at-least two income sources. Passive income though sounds fascinating, should be looked upon with a keen understanding of the subject and taking calculated risks. Passive income is always better than active because the amount of time you invest in earning is comparatively less than that needed to earn active income and the time left over can be utilised in gaining knowledge about other things and even building another income stream.

Other animals are instinctively driven to build things like dams or honeycombs, but we are the only ones that can invent new things and better ways of making income out of it.

There is no formula for success before income, you have to work hard to earn it. You can expect the future to take a definite form or you can treat it hazily and be uncertain. If you treat the future as something definite, it makes sense to understand it in advance and to work to shape it. But if you expect an indefinite future ruled by randomness you'll give up on trying to master it. You have to think about the need of hour and work accordingly to achieve any of the above incomes and be a successful individual with massive payrolls !